cash receipt free printable template

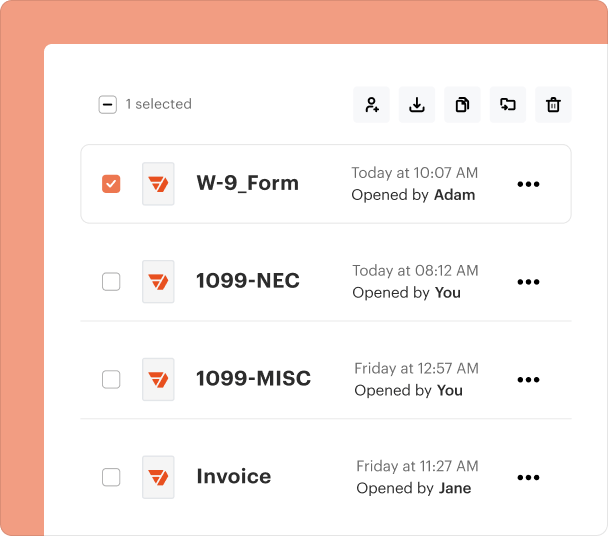

Fill out, sign, and share forms from a single PDF platform

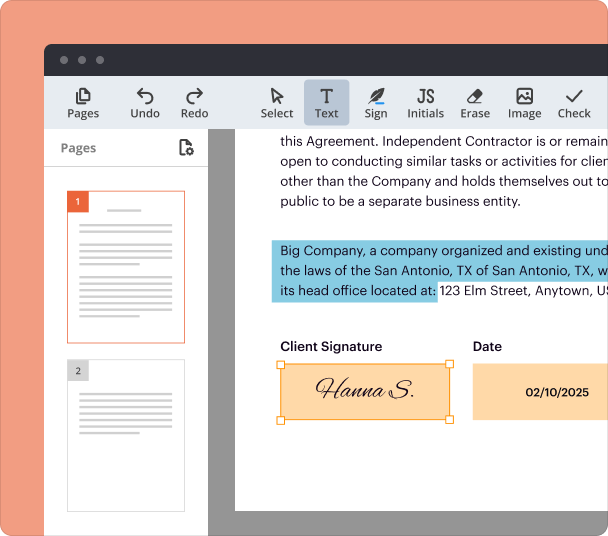

Edit and sign in one place

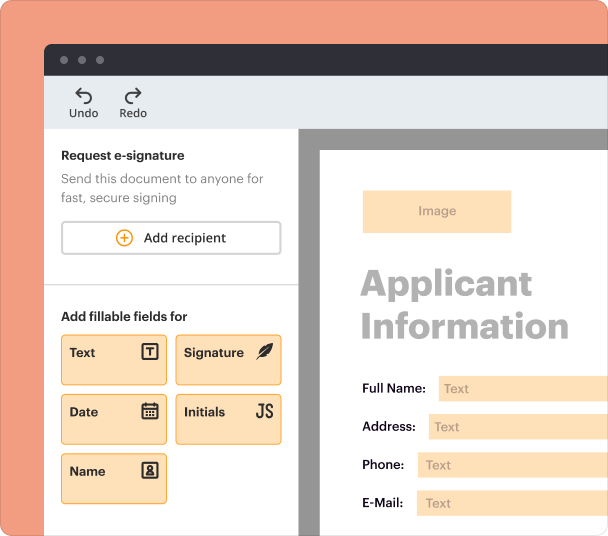

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

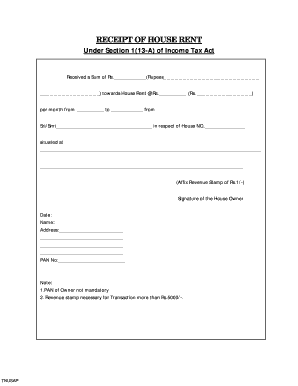

Comprehensive Guide to Cash Receipt Printable Template Form

What is a cash receipt printable template?

A cash receipt printable template is a customizable document used to confirm the receipt of cash payments. It typically includes essential information such as the date, payer details, total amount due, and payment method. This template serves as a record for both the payer and the payee, ensuring clarity in financial transactions.

Key features of the cash receipt printable template

This template includes several key features to enhance usability and accuracy. Users can input the date, name and address of the payer, and the amount received. There are dedicated sections for indicating the purpose of the payment and the payment method, whether cash, check, or money order. Additionally, the template allows for a signature section to validate the transaction.

When to use a cash receipt printable template

This template is suitable for various situations where cash transactions occur. It is commonly used by businesses for sales transactions, service providers confirming payments received, or any situation involving cash exchanges. Using this template helps maintain accurate financial records and provides a reference for future inquiries.

How to fill out the cash receipt printable template

Filling out the cash receipt template is straightforward. Begin by entering the date at the top of the form. Next, fill in the 'Received From' section with the payer's name and address. Specify the amount received in dollars and the reason for the payment in the 'For' section. Indicate the total due and any balance, then select the payment method. Finally, ensure to include the signature of the individual acknowledging the receipt.

Best practices for accurate completion

To ensure the accuracy of the completed cash receipt, double-check all entered information. Use clear, legible handwriting for manual entries, or consider utilizing a fillable format to reduce errors. Always retain a copy of the completed receipt for organizational records and provide the payer with a copy as proof of payment.

Common errors and troubleshooting

Common errors when filling out the cash receipt printable template can include incorrect amounts, misspelled names, and failure to date the receipt. If mistakes occur, use correction fluid or write a new receipt, avoiding alterations on the original document. If there are discrepancies in amounts paid versus amounts listed, ensure that both parties have a clear understanding to avoid future confusion.

Frequently Asked Questions about rent receipt template form

What is the purpose of a cash receipt printable template?

The purpose of a cash receipt printable template is to provide a documented record of cash transactions, ensuring clarity and accountability for both parties involved. It serves as proof of payment and can be used for accounting purposes.

Can I customize the cash receipt printable template?

Yes, users can customize the cash receipt printable template to suit their specific needs. This includes adding logos, changing text fields, and adjusting layout elements to fit unique transaction requirements.

pdfFiller scores top ratings on review platforms